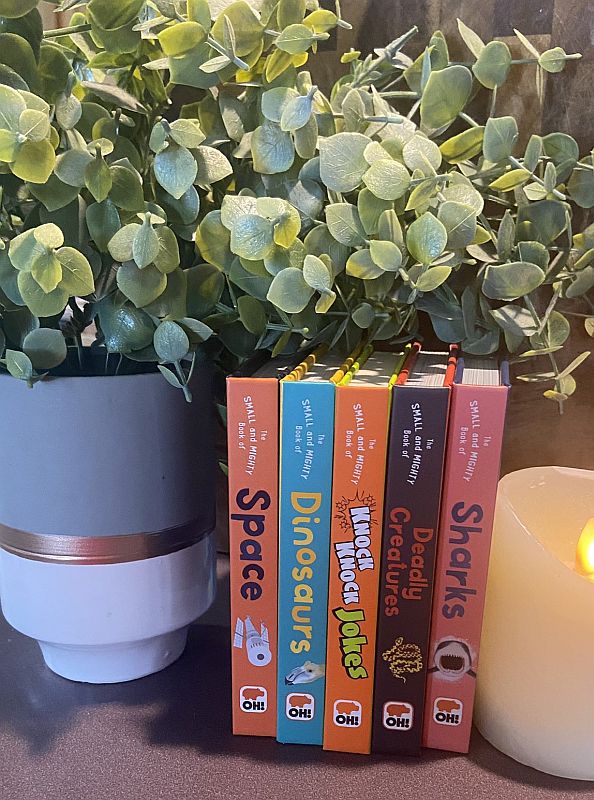

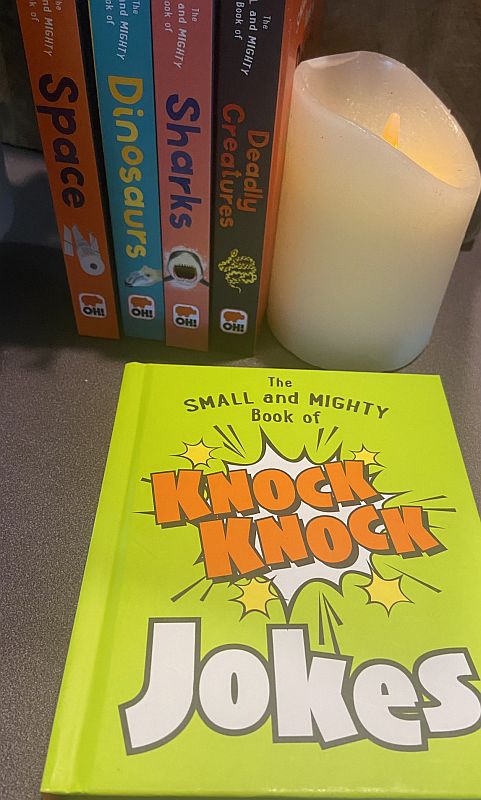

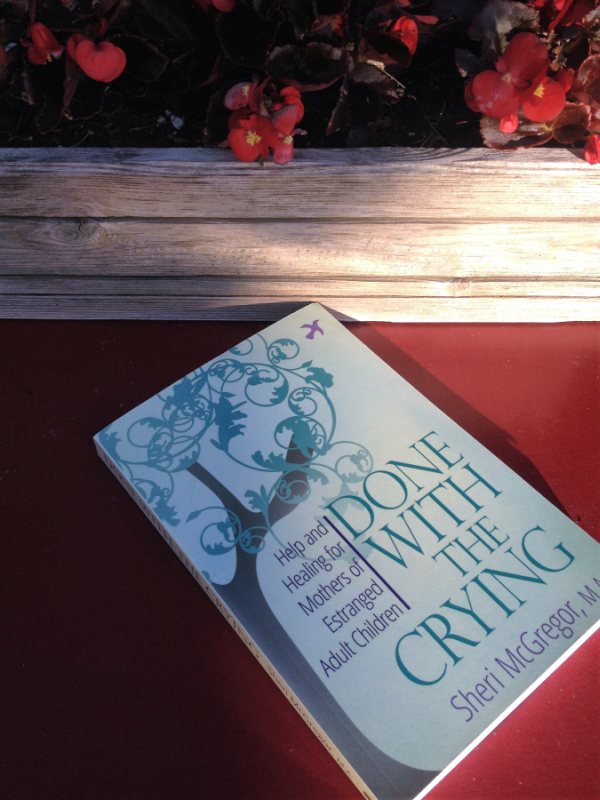

The Small and Mighty Books

I was sent an absolutely WONDERFUL set of “Small and Mighty” Children’s books in exchange for telling my readers all about them and it is my ABSOLUTE pleasure to do that today. I’m always excited to write a book review and tell others about great books because I love reading so much and believe reading to be one of the best things we can do for ourselves. That’s one of the reasons why I’m even more excited about this book review than many others – it involves children (people I love with all my heart and soul!) and the thought of developing a love of books and learning from an early age is something I get incredibly excited about!

Given the number of exclamation points, adjectives, and bold words in the paragraph above, I guess you can tell how excited I am!

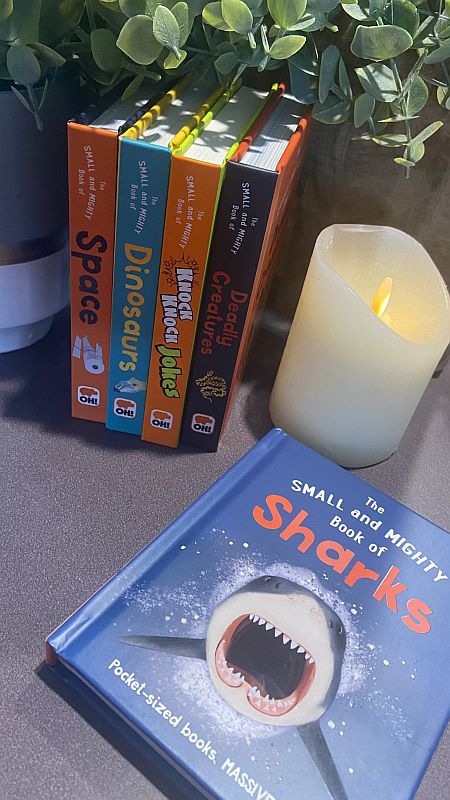

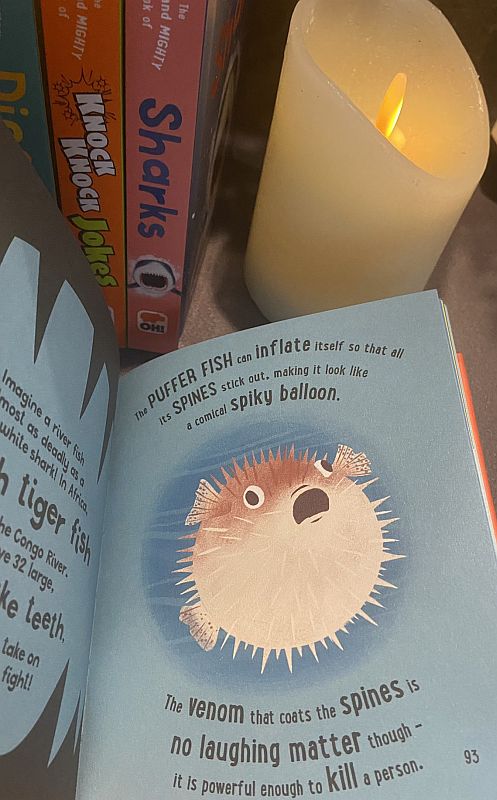

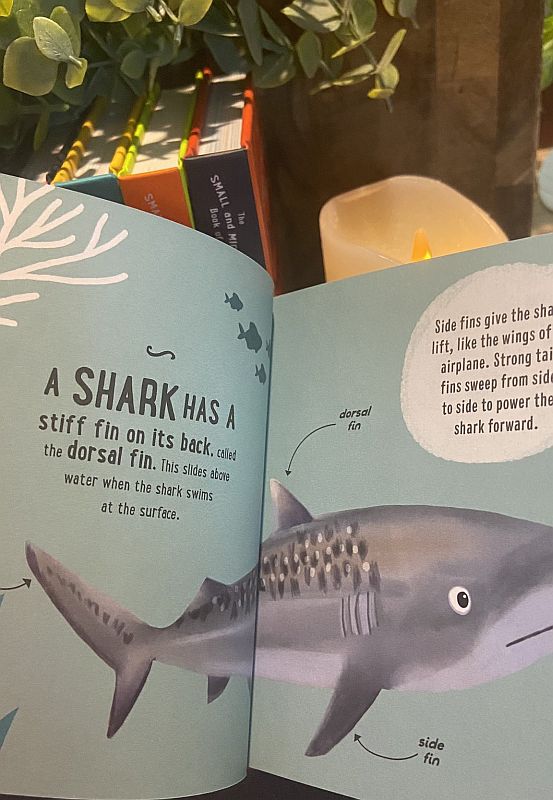

The Small and Mighty Book of Sharks (Amazon affiliate link)

But the benefits of reading with children goes even further than that. I’m talking, of course, about the unspeakably beautiful time you spent with children who hung the moon in your sky… sitting side by side while reading together is, quite frankly, something so magical I’m at a loss for words. When you can take part in opening the world up to children, it’s nothing short of a natural high (and one you never come down from).

I also love the fact that time spent reading with children has other benefits:

- You’re preparing them for school by giving them an edge on either learning to read or improving their reading skills. When you ask questions after reading, you cause the child to think and recall what has been read. What’s more, with the right types of questions, such as, “Which dinosaur do you think was the most ferocious?!” you help hone their reasoning skills.

- If you homeschool your children (as I did my three daughters), a great library is absolutely essential. The more books, the more subjects, and the more reasons to love learning the better.

- When you read informative books such as the ones in this collection, you get “two-fold” benefits. You get the time spent with the child, you teach them to love reading (and learning), you help their skills of recollection and reasoning, AND you teach them facts that, again, will give them an edge for school. When the teacher begins talking about space, sharks, dinosaurs, insects, etc… the child who had already been exposed to the wild and wonderful world of each has an edge. Not only does such an edge help with learning, it greatly increases their confidence and a confident child is ready to take on the world.

- I read a LOT to my girls when they were little and I read a LOT to my three grandbabies (ages 3, 4, and 6… all boys, so I pretty much know all there is to know about bugs and dinosaurs at this point!). Reading with children creates the perfect atmosphere to talk and discuss things – sometimes even beyond what you’re reading about. When the child knows you care enough to sit and share a book with them, to share your time and your love of learning, they will open up to you and the bond becomes invincible.

- I love when, even WEEKS or MONTHS after reading a book, the child will bring it up and talk about what a certain character did or how a male seahorse gives birth to babies (something that perfectly amused my grandbabies!).

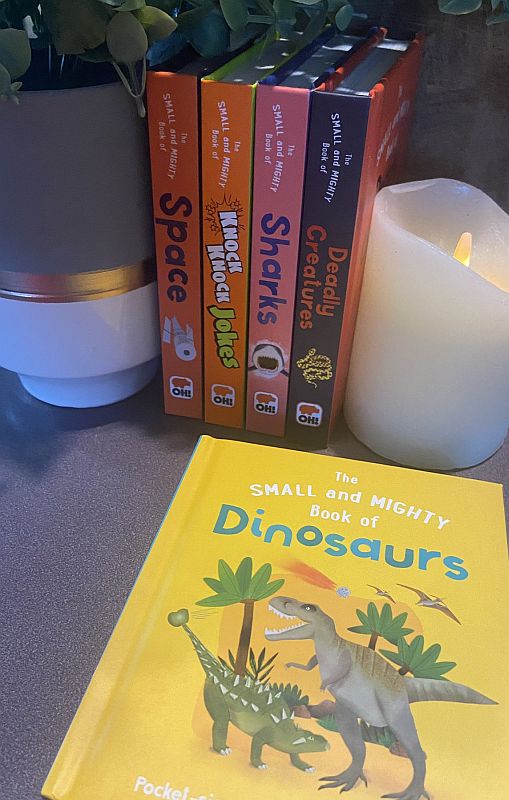

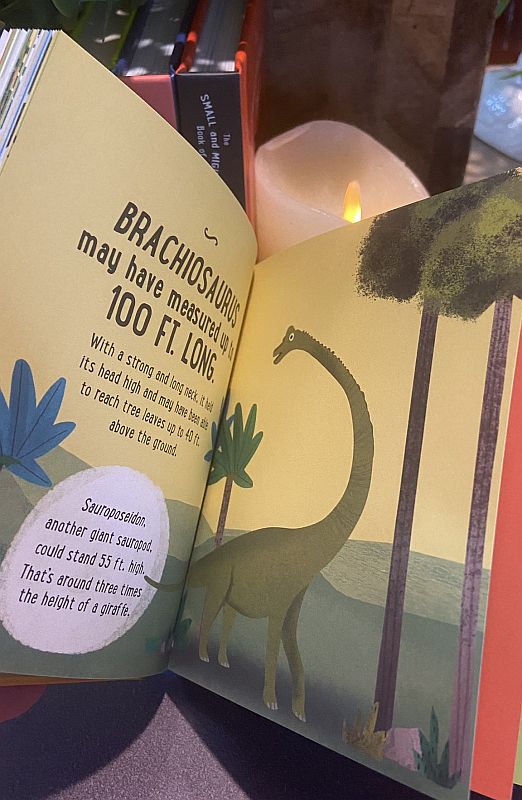

The Small and Mighty Book of Dinosaurs (Amazon Affiliate link)

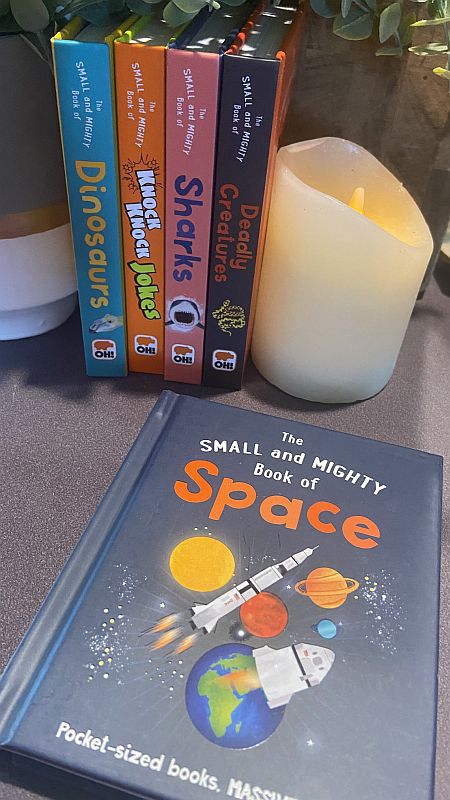

The amazing Small and Mighty Books from Orange Hippo are absolutely delightful in every way. They’re small, extremely well-made and durable (as a MiMi to three little boys, I am so grateful for this blessing!), FUN to read, have exciting and wonderful pictures, and are packed with fun-to-learn information.

I can imagine each of my grandbabies one day telling their friends, parents, or teachers how the planet Saturn is so light it could float in a bowl of water.. IF, as the book The Small and Mighty Book of Space (Amazon affiliate link) states, you could find a bowl big enough!

The Small and Mighty Book of Space (Amazon affiliate link)

The books you see in this book review post are the ones I was sent to take a look at and I love each one so much. Even the delightful The Small and Mighty Book of Knock Knock Jokes (Amazon affiliate link) has merit because…

- It makes reading super FUN for the child.

- I’ve always felt that humor sharpens your skills – there’s something about puns and sarcasm that sharpen the brain cells and kids get a huge kick out of it. They absolutely LOVE repeating jokes and, again, doing so, is simply very, very good for them mentally AND helps them to see what a joy it is to make others smile and laugh. A tremendous lesson in itself, if you ask me.

The Small and Mighty Book of Knock Knock Jokes (Amazon affiliate link)

The hardcover (again, incredibly well-made yet extremely reasonably priced) books are, in my opinion, great for any age child. I can read them easily to a three year old and keep his undivided attention and children in any grade would greatly enjoy them. They’re between 5 and 6 inches tall and the length of pages ranges from 143-192.

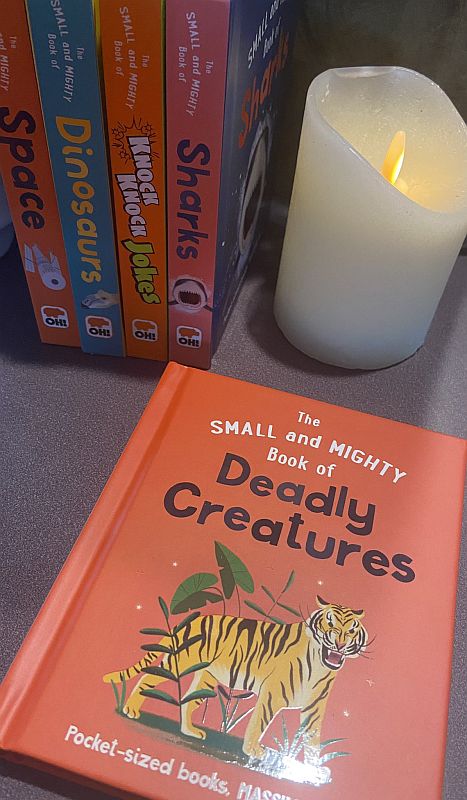

The Small and Mighty Book of Deadly Creatures (Amazon affiliate link)

Where to Buy The Small and Mighty Books for Children:

I’ve personally only seen them on Amazon (which, fortunately has each of the ones pictured here). I actually saw a few other titles today which I’ve already ordered (Bugs, Oceans, Myths & Legends, and Penguins) because I want my grandbabies to have the complete set. Click here (Amazon affiliate link) to see each of the titles Amazon carries.

The Small and Mighty Book of Dinosaurs (Amazon Affiliate link)

The illustrations are absolutely stunning – I had an impossible time trying to decide which photos (and facts!) to spotlight in these final photos.

The Small and Mighty Book of Deadly Creatures (Amazon affiliate link)

I can’t possibly recommend these children’s books enough – I hope you’ll add them to your child, grandchild, or nephew/niece’s library right away. Trust me, you’ll thank yourself for years to come.

~ Joi (“Joy“)

The Small and Mighty Book of Sharks (Amazon affiliate link)